TCFD Reporting

Global Investment & Engineering Grade

Physical Climate Risk Analysis Report

The Need For TCFD Reporting

Following the Task Force on Climate-related Financial Disclosures (TCFD) recommendations delivered by the FSB in 2018, there has been an accelerated focus on TCFD reporting by industry and government recognising the need for disclosure of the financial implications of climate change.

It’s now widely recognised that climate change presents a material threat to business operations, investment portfolios and economic stability. XDI leads data driven tcfd reporting and analysis to address what regulatory bodies worldwide are requiring for the financial disclosure of physical climate risk. This includes direct impacts of current and future weather events, and stress testing of asset portfolios.

XDI works extensively with infrastructure organisations, property trusts, banks and investment firms to support climate financial disclosure in Australasia, Europe, UK and North America. As decision makers strive to expand the management of the issue, XDI is rapidly delivering the data that supports those needs.

World Leading Physical Climate Risk Analysis & TCFD Reporting

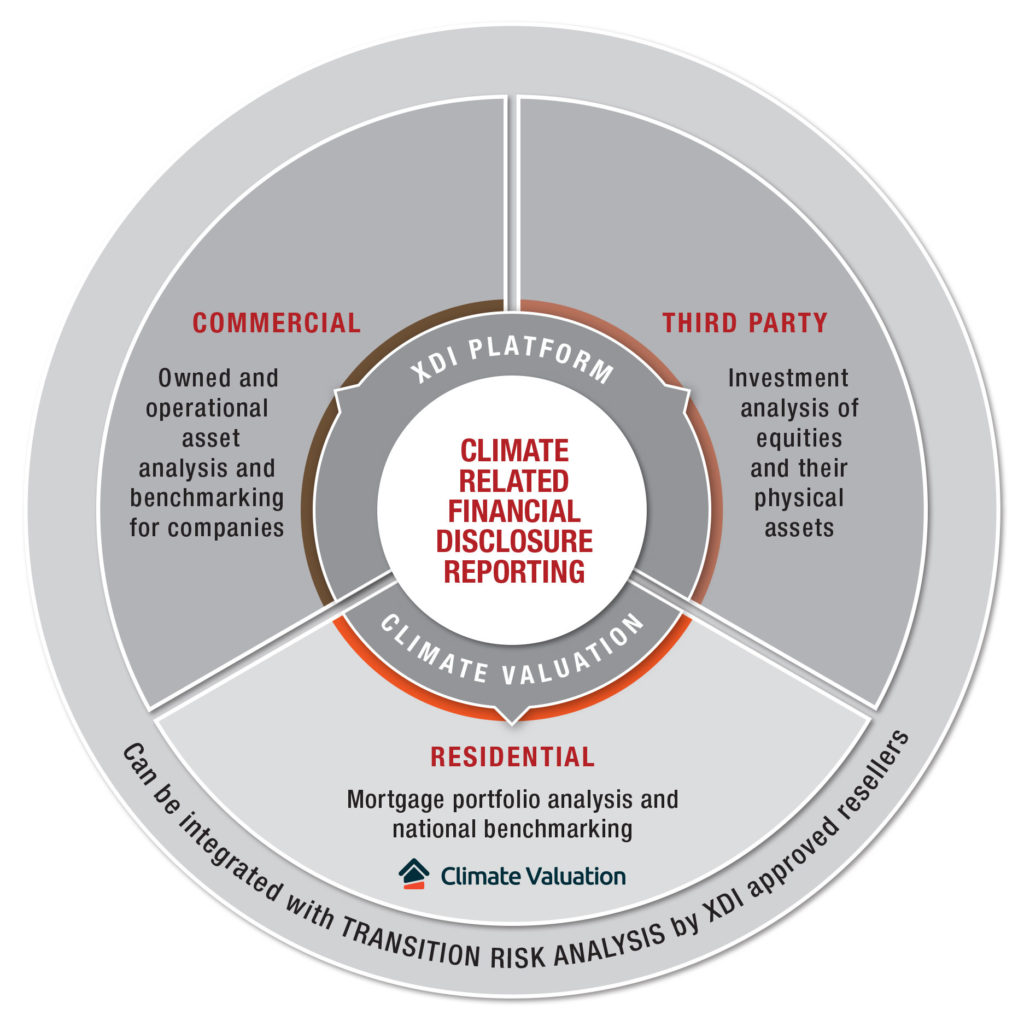

XDI Analysis Supports Climate Related Financial Disclosure - TCFD Reporting

Direct & Indirect Risk

Hazard impacts over time

Business disruption probability

Loss of productivity

Economic impacts by region

Upstream dependencies for critical infrastructure assets

Impacts on insurability

Emissions Scenarios

For physical risk analysis:

RCP 8.5 is used to stress test assets or portfolios under a worst-case emissions scenario

RCP 2.6 is used for best case scenario

RCP 4.5/6.0 can be added for a moderate mitigation pathway

Time Frames

Probabilistic analysis:

Five year or per decade

With baseline from 1990 to 2100

Metrics and Outputs

Average Annual Loss

Total Technical Insurance Premium

Percentage of Value-at-Risk

Number of High Risk Properties

Percentage of High-Risk Properties

Failure Probability

Productivity Loss

XDI TCFD Physical Risk Reports provide over 40 slides of analysis results

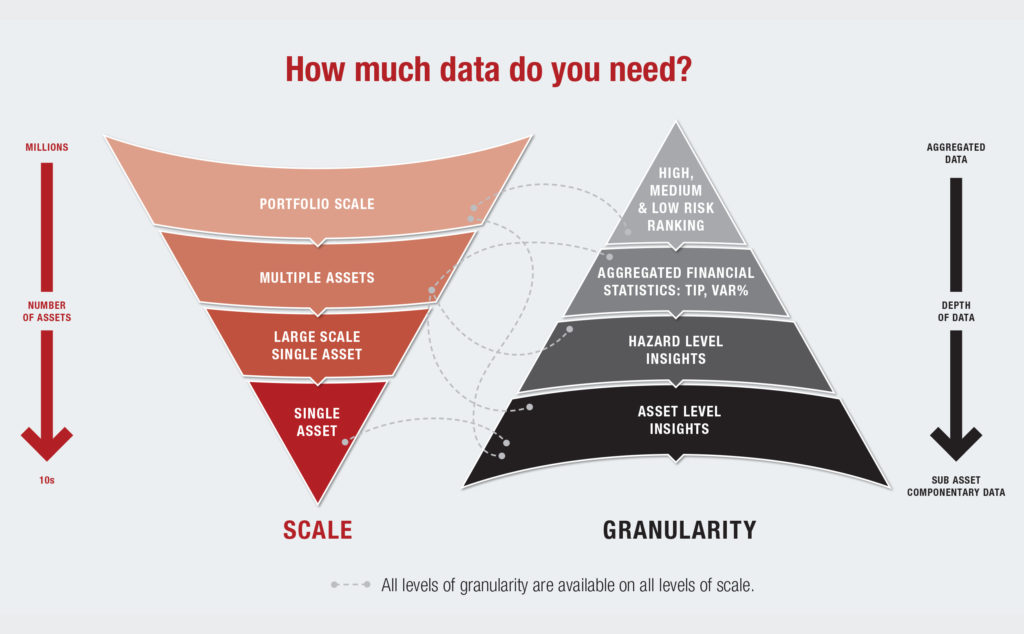

Global Scale. Asset Level Granularity

XDI starts with asset level analysis, specified down to component parts, then scales up to stress test whole portfolios for physical climate risk around the world.

“GPT wanted a deeper understanding of the potential climate related risks that are foreseeable for our fixed property assets. We used XDI to model our asset level physical risks and then work with our development and capital works teams to implement practical solutions to minimise the potential impacts. XDI is a key tool in our climate adaptation planning.”

Steve Ford

Head of Sustainability & Energy The GPT Group

XDI Approved Re-sellers

We have established resellers providing transition risk analysis in UK and Europe, Australasia, and North America.

Global leaders in Physical Climate Risk Analysis & TCFD Reporting

XDI analysis ranks the highest for hazards covered, geographical reach, and capacity for analysis of large numbers of assets.

Companies asset data

Countries covered

Residential addresses analyzed

Commercial assets analyzed

Powered by the award-winning Climate Risk Engines, the XDI Platform accesses asset data for over 9,000,000 companies around the world. To date, XDI has analysed over 37 million residential addresses and 2,000,000 commercial assets globally.

INSIGHTS - TCFD Blog ARticle

XDI’s Top Ten TCFD Physical Risk Tips for Companies

With New Zealand making Task Force on Climate-related Financial Disclosures (TCFD) reporting compulsory and the Canadian government linking mandatory TCFD reporting to corporate COVID relief, it’s the time for businesses to make TCFD a standard part of their risk management regimes. As former Governor of the Bank of England and current United Nations Special Envoy on Climate Action and Finance Mark Carney has said, all companies need to understand and use the TCFD system as climate risks increase. Click here to read the full Blog Article